When some in the Advanced Deposit Wagering (ADW) industry think of GeoComply, their first thought might be geolocation compliance—a foundational technology in regulated sports betting and iGaming. But even though ADW operators are not subject to the same strict geolocation regulations, they face many similar fraud risks. GeoComply’s capabilities, however, extend well beyond compliance, providing powerful tools that help horse racing platforms detect fraud, block bad actors, and uncover valuable business insights.

Fraud and promotional abuse continue to erode profit margins across digital gaming. A 2023 TransUnion study found that fraud accounted for nearly 11% of digital gaming activity, steadily rising year-over-year. Without effective safeguards, unchecked fraud can siphon up to 15% of an online operator’s gross revenue. For ADW operators—especially during high-traffic periods like the Triple Crown season—the threats are escalating: account takeovers, bonus abuse, chargebacks, proxy betting, OFAC violations, and even money laundering schemes. The good news? These risks can be effectively managed, and often completely mitigated, by implementing the right technologies.

The surge in betting activity during major horse racing events, combined with sophisticated fraudster tactics, makes ADW platforms highly attractive targets for coordinated abuse and financial schemes.

Timing is everything: triple crown season and increased risk

We are currently in the heart of the Triple Crown season, when horse racing captures global attention and wagering activity surges. The Kentucky Derby, Preakness Stakes, and Belmont Stakes draw not only passionate fans but also waves of casual bettors and newcomers. With this influx of activity comes increased exposure to fraud and abuse, making it more important than ever for ADW platforms to have robust defenses in place.

Location and device data: a comprehensive defense

GeoComply’s ability to gather location and device data and then apply extensive analysis, algorithms, and machine learning creates a comprehensive suite of fraud detection and prevention tools that provide critical security, fraud, and business intelligence. For horse racing operators, harnessing GeoComply’s complete toolkit doesn’t just protect your business—it fortifies your relationship with your customers by creating a trusted, secure wagering environment, especially vital during peak events.

Post-race day, GeoComply provides a robust defense against bettors who choose to offset their losses by disputing their deposits and wagers with their bank or credit card company. ADW operators can fight these first-party or “friendly” fraud attempts with compelling evidence reports (generated in less than 60 seconds) using the same location and device data, which can provide up to a 90% win rate against these chargeback disputes.

Derby week: a case study in fraud prevention

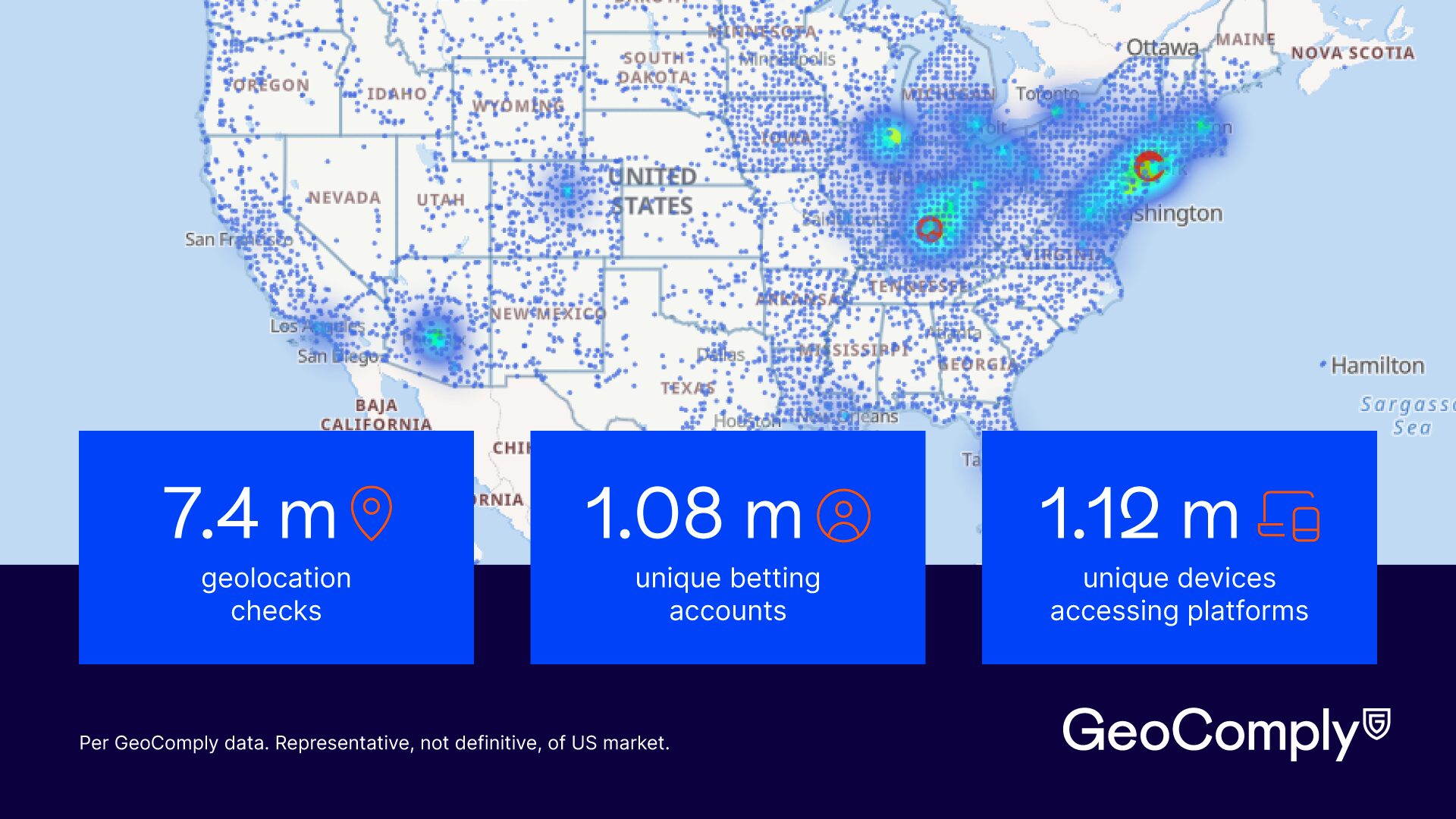

Let’s explore the 2025 Kentucky Derby week as an illustrative example:

- 7.4 million geolocation checks performed

- 1.08 million unique betting accounts

- 1.12 million unique devices accessing platforms

Despite the absence of compliance-driven geolocation mandates, GeoComply’s technology flagged and stopped significant fraudulent and illegal activity:

- Approximately 1,000 instances of location jumping were identified, marking a five-fold increase from the previous week. Location jumping, characterized by unrealistic movement speeds between transactions, frequently signals account sharing, proxy wagering, underage gaming, and potential AML concerns.

- Advanced location spoofing accounted for the majority of blocked transactions. Spoofing attempts from high-risk locations and OFAC-sanctioned jurisdictions underscore the reality that sophisticated fraud threats and criminal activity aren’t limited to regulated sports betting alone.

Real-time defense, real-world impact

GeoComply’s real-time detection technology is designed specifically to catch:

- Location Spoofing: Preventing transactions originating from locations flagged as high-risk and the use of data manipulation, VPNs, and Fake Location Apps.

- Device Sharing: Identifying and halting multi-accounting and bonus abuse.

- Proxy Betting: Blocking wagers placed from unrealistic locations, indicative of third-party or underage betting.

- Account Takeover: Identifying new devices and locations attempting access from established player accounts is an indicator of fraudulent activity that could quickly withdraw a player’s funds. These attempts can be neutralized and prevented.

- AML/OFAC Sanctions Compliance: Blocking access from designated high-risk countries such as China, Iran, Russia, and Cuba.

Enhancing business intelligence and customer relationships

Aside from directly combating fraud, GeoComply’s GeoAnalytics dashboards also offer vital insights into a racebook’s marketing spend and bettors’ behavior. Operators can leverage these insights to refine marketing strategies, customize promotions, and ultimately, enhance the customer experience and loyalty, particularly important during the high-volume Triple Crown season.

Conclusion

GeoComply empowers horse racing operators to stay ahead of sophisticated fraud, safeguarding revenue and player trust when stakes are highest.

While geolocation compliance might be the foundation upon which GeoComply was built, GeoComply is now an industry-leading risk solutions and services company. For horse racing operators, especially during high-profile events throughout the Triple Crown season, GeoComply’s location-enhanced risk tools and services enable ADW operators to stay ahead of increasingly sophisticated fraud threats, protecting reputation and building stronger, safer relationships with customers when stakes – and risks – are at their highest.

Want to learn how GeoComply helps horse racing operators cross the finish line safely and securely, protecting revenue and player trust? Connect with a GeoComply expert today to learn how we can help.